As another inflation-battling year wraps up, the Bank of Canada’s mission to reestablish value steadiness is supposed to start attracting to a nearby in 2024.

The national bank’s heavy rate climbs are at last proving to be fruitful, permitting it to hold its key interest rate consistent at five percent throughout recent months.

The financial lull is supposed to lay the basis for interest rate cuts as soon as mid-2024, which would flag a defining moment in the battle against inflation.

Desjardins’ main financial expert says albeit the national bank’s rate climbs have made sense of inflation, a ton of the lull in cost development has likewise come from worldwide cost pressures facilitating.

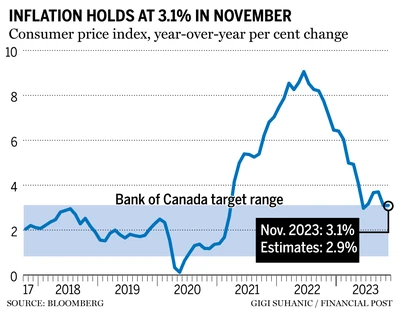

“We’re taking a gander at inflation 3.1 percent, presently significantly less unpleasant than it was a year prior,” said Jimmy Jean, boss financial specialist at Desjardins.

“Furthermore, part of it, I think, is indeed, the moves the bank has made. In any case, one more part is additionally things that were supposed to (resolve) by their own doing.”

A large number of the worldwide elements that added to the precarious runup in costs, as ruined supply chains and high energy costs, have disappeared.

Furthermore, presently exorbitant interest rates are wrapping up of the work.

Reestablishing value steadiness will be very positive news for Canadians, especially lower-pay families who been the hardest hit by climbing basic food item bills and leases.

Be that as it may, returning to low and stable inflation won’t come without some aggravation.

Variable rate contract holders were quick to feel the spot of rate climbs. In any case, over the long haul, that press is gradually spreading to different property holders also.

More Canadians are supposed to recharge their home loans one year from now at higher interest rates, compelling them to scale back costs somewhere else.

Paul Beaudry, a previous delegate lead representative at the Bank of Canada, says this addresses the inconsistent impacts of both inflation and interest rates.

“The instruments that are utilized at the Bank of Canada, particularly the interest rate, hits individuals incredibly, differentially,” Beaudry said.

“On one section, you mustn’t fail to remember those gatherings that really benefited by bringing (inflation) down. At the other side, you have different gatherings that were more hit (by rate climbs).”

As per scientists at the Bank of Canada, around 45% of home loans that were taken out before the national bank began raising rates had seen an expansion in their installments toward November’s end.

The analysts say virtually all excess home loan holders in this gathering will reestablish toward the finish of 2026, logical significance higher installments for them also.

This flood of home loan restorations is supposed to chillingly affect the economy.

Estimates recommend monetary development will be frail in 2024 preceding getting in the future close to the furthest limit of the year.

Desjardins is extending a gentle downturn in the main portion of the year, while different forecasters anticipate that the economy should keep its head somewhat above water.

Be that as it may, assuming the economy skirts a downturn and inflation falls back to two percent, it will mean the national bank effectively strolled the tight rope between raising rates by excessively little or to an extreme.

For laborers, a more vulnerable economy will mean less open positions accessible and possibly more slow compensation development.

The joblessness rate has crawled up to 5.8 percent in November and is supposed to keep ascending one year from now.

Desjardins is anticipating the joblessness rate will top at 7.0 percent in the second from last quarter one year from now.

The Bank of Canada has confronted a ton of examination over the most recent few years, especially from the political domain, for its strategy choices since the Coronavirus pandemic hit.

Moderate Pioneer Pierre Poilievre eminently promised to fire lead representative Altercation Macklem, faulting the national bank for the run up in inflation and blaming it for supporting government spending.

Others, including New leftists and premiers, have stood up against the quick rate climbs on account of the monetary crush they would cause for families.

Beaudry says the politicization of the national bank during this time of high inflation supports why it’s critical to have a national bank that can settle on the ideal choices, paying little heed to how disagreeable they might be.

“I’m not shocked the amount it gets politicized during an inflation period. My thought process is the significant part is to perceive how once this is finished, and individuals think back, what believability the bank will have. My get it will have a lot of believability,” Beaudry said. This report by The Canadian Press was first distributed Dec. 24, 2023.